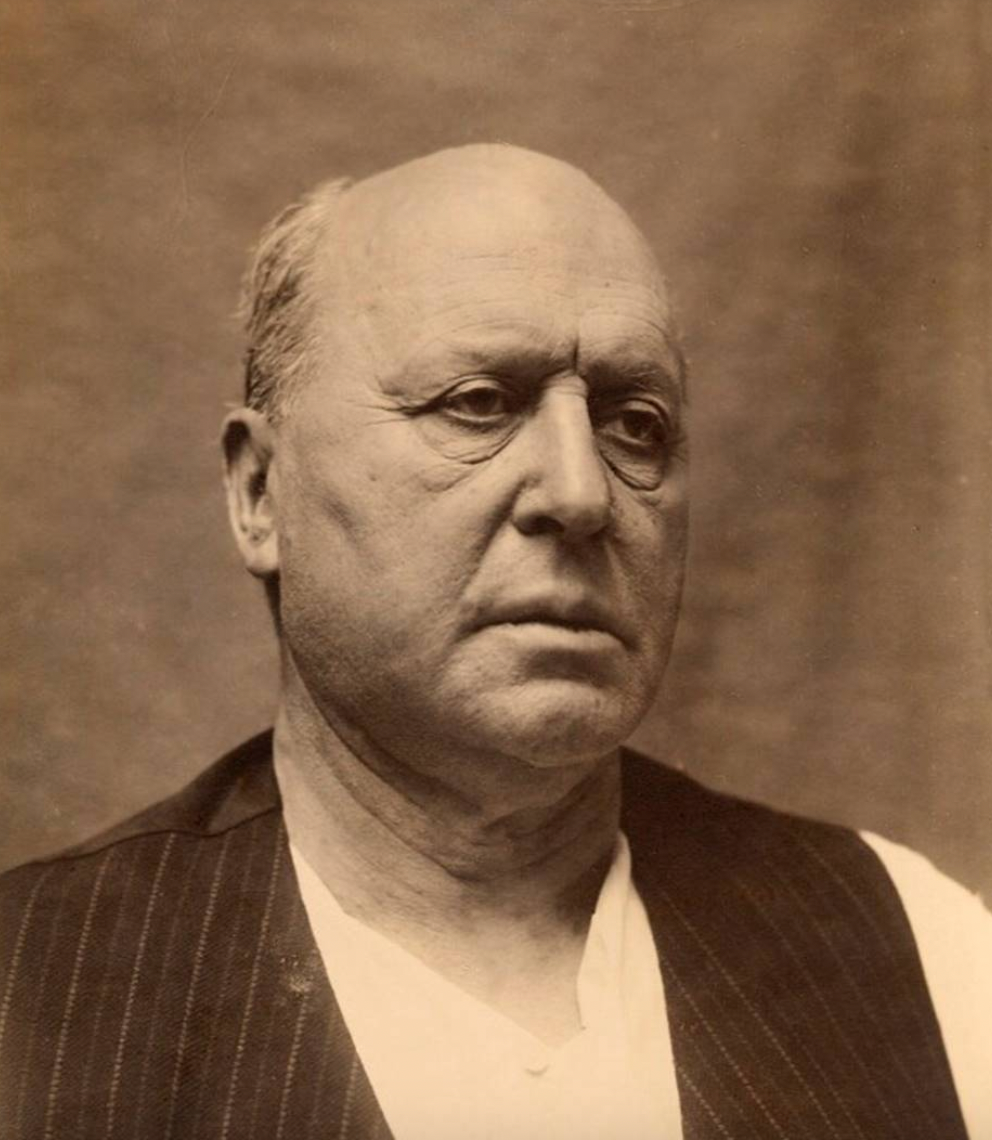

Judge James Shapiro on Blogger

Judge James Shapiro - Longtime Chicago Legal Professional

Tuesday, October 10, 2023

Published: The History of Golf in the Summer Olympics

Thursday, October 5, 2023

Tuesday, September 12, 2023

Published: A History of the US Open in Illinois

Tuesday, August 22, 2023

Published: How Asset Division Works in Illinois Divorce Suits

Wednesday, July 12, 2023

An Introduction to Alimony in Illinois

Like all states in the nation, Illinois maintains alimony laws. Alimony, also called maintenance or spousal support, is a form of financial support paid by one spouse to the other during separation proceedings or following a divorce. Several factors influence whether alimony payments must be paid, who must pay them, the amount of payments, and the duration, all of which are dictated by the Illinois Marriage and Dissolution of Marriage Act. Illinois’ alimony laws were completely overhauled in 2019.

Courts evaluate various aspects of marriage before making decisions regarding alimony. Basic considerations involve each spouse’s financial standing and need, their current and future earning power, and specific hindrances to future earnings related to the marriage, such as childcare arrangements preventing one spouse from continuing along their anticipated career track.

Other factors range from the standard of living spouses had together to tax obligations resulting from the division of assets. Of course, prenuptial and post-nuptial agreements often stipulate how long a marriage must last before spousal support becomes an option, the maximum amount of spousal support, and other elements.

It should be noted that not all divorces in Illinois result in one of the spouses receiving alimony. Individuals should also be aware that courts can award alimony if they deem spousal support payments “just and equitable,” which allows for considerable discretion.

Calculating alimony payments is relatively straightforward. A spouse must pay 33 percent of their net income less 25 percent of the recipient’s net income. The resulting total is the annual total, to be paid out in monthly installments. For example, if the paying spouse makes $3,000 monthly and the receiver earns $1,000 monthly, the monthly spousal support payment works out to $750. A spouse making $6,000 would pay the same receiving spouse $1,750 per month.

There are a few additional caveats that must be considered. To start, the receiving spouse cannot receive alimony payments resulting in their annual income exceeding the couple’s net income by 40 percent. Additional factors include the length of the marriage and the financial impact of debts and asset division. This basic formula is sometimes altered when applied to spouses with a combined annual income exceeding $500,000, or to a spouse already making child support payments under a previous court order.

The length of the marriage is also important when determining the duration of spousal maintenance payments. Courts primarily base the length of payments on a percentage of the length of the marriage, with the percentage increasing by 4 percent for each year of marriage. Individuals married for five years or less pay alimony for 20 percent of the length of the union, while individuals who have been married for 19 years must pay more than 15 years of alimony. For marriages of 20 years or more, courts have some discretion in regard to ordering permanent spousal support.

Alimony is one of several complex aspects of the divorce process. Furthermore, aspects of alimony law are subject to change at any time. As mentioned, Illinois lawmakers significantly overhauled alimony legislation in 2019. Individuals preparing for a separation or divorce are strongly advised to seek the counsel of an Illinois family law attorney.

Published: The History of Golf in the Summer Olympics

I published “The History of Golf in the Summer Olympics” on @Medium

-

I published “The History of Golf in the Summer Olympics” on @Medium

-

I published “A History of the US Open in Illinois” on @Medium

-

I published “How Asset Division Works in Illinois Divorce Suits” on @Medium